brian maass

Berkshire Hathaway

Berkshire Hathaway (BRK.A / BRK.B) rallied to numerous all-time highs in 2024 and 2025 and crossed a market cap of over $1 trillion in late August 2024. There are only 8 other US companies with a higher valuation.

Despite this seemingly high valuation, Berkshire is a compounding machine having retained nearly all of its $700 billion in earnings. No company has ever done anything like this! It's almost as if Warren is using Berkshire as an academic exercise on compounding. Berkshire Hathaway has many enduring advantages that will allow it to continue to outperform the majority of S&P500 Companies over time.

Since 2018, operating earnings are accelerating faster and share repurchases have increased. See analysis on share repurchases, updated intrinsic value estimates and 2025 price targets.

BRK.A = 1,500 shares BRK.B

BRK.A currently trades at .1% premium to BRK.B

History of Berkshire Share Repurchases

Why is this 2018 change so significant?

Berkshire Hathaway has only changed its buyback philosophy 3 times in almost 60 years (2011, 2012 and 2018). These changes are not done without lots of intentional considerations. Since this last share repurchase authorization change in 2018, Berkshire Hathaway has consistently been repurchasing shares of the company. In fact, Berkshire has repurchased over 13% of the company shares and is generating cash such that they still have record amounts of cash on hand ($348+ billion as of March 2025). The BRK.A share price before this 2018 change was $288,500.

On May 2, 2025, BRK.A shares closed at $809,350 which is a 164.4% return since July 2018. This exceeds S&P returns over that same time period (~117% total return with dividends reinvested).

What do we know? Berkshire is still trading at less than its intrinsic valuation (conservatively determined) as defined in the Berkshire's share repurchase authorization. All I know, is Warren has proven very conservative over the last 50-60 years. These repurchases are added significant value to the remaining shareholders. So what is the intrinsic value of Berkshire Hathaway?

No share repurchases since Q2 2024

Berkshire Analyst 2025 Target Prices

BRK.A Target ranges from $699,000-$889,500

BRK.B Target ranges from $575-$593

UBS (Brian Meredith) – Reiterated Buy ratings throughout 2025 while adjusting price targets for both Class A and B shares (e.g. raising BRK.A to $836,135 post-Q4 2024, then up to $909,218 in April, etc., and BRK.B to $597 by August 2025) . In October 2025, UBS trimmed the BRK.B target to $593 (maintaining a Buy rating)

Keefe, Bruyette & Woods – KBW (Meyer Shields) – Maintained a Market Perform (Hold/Neutral) on BRK.A through early 2025, raising the target from $750,000 to $775,000 after strong 2024 results . In a rare bearish move, KBW downgraded Berkshire to Underperform in Oct 2025, cutting the Class A target to $700,000 (from $740k).

Argus Research (Kevin Heal) – Initiated/maintained coverage with a Buy rating on BRK.B, setting a target of $575 in March 2025. (Argus viewed Berkshire as a solid long-term value holding, and this $575 target remained unchanged through mid-2025.)

BRK.A - Analyst Price Targets

$699,000 - Oct2025 - KBW - Meyer Shields

$889,500 - Oct2025 - UBS - Brian Meredith

$895,500- Aug2025 - UBS - Brian Meredith

$892,500 - Jul2025 - UBS - Brian Meredith

$909,218 - May2025 - UBS - Brian Meredith

$862,500 - Mar2025 - Argus - Kevin Heal

$836,125 - Feb2025 - UBS - Brian Meredith

$775,000 - Feb2025 - KBW - Meyer Sheilds

$807,000 - Oct2024 - UBS - Brian Meredith

$735,000 - Oct2024 - KBW - Meyer Shields

$721,500 - Apr2024 - UBS - Brian Meredith (+6,500)

$715,000 - Feb2024 - UBS - Brian Meredith (+$60,000)

$708,000 - Feb2024 - CFRA Research - Cathy Seifert

$645,000 - Feb2024 - KBW - Meyer Shields (+$35,000)

$655,000 - Jan2024 - UBS - Brian Meredith (+$30,000)

BRK.B - Analyst Price Targets

$466 - Oct2025 - KBW - Meyer Shields

$593 - Oct2025 - UBS - Brian Meredith

$597 - Aug2025 - UBS - Brian Meredith

$595 - Jul2025 - UBS - Brian Meredith

$606 - May2025 - UBS - Brian Meredith

$575 - Mar2025 - Argus - Kevin Heal

$557 - Feb2025 - UBS - Brian Meredith

$516 - Feb2025 - KBW - Meyer Shields

$538 - Oct2024 - UBS - Brian Meredith

$490 - Oct2024 - KBW - Meyer Shields

$481 - Apr2024 - UBS - Brian Meredith

$477 - Feb2024 - UBS - Brian Meredith

$472 - Feb2024 - CFRA Research - Cathy Seifert

$430 - Feb2024 - KBW - Meyer Shields

$435 - Jan2024 - UBS - Brian Meredith

Intrinsic value estimates of Berkshire Hathaway

2 well-know individuals focused on understanding the components of Berkshire Hathaway over the years (their estimates range from $743,000-$783,000/per A share)

Semper Augustus

Annual intrinsic value analysis (~60 pages) by Christoper Bloomstrand of Semper Augustus Investment Group LLC

2024 - $1.126 trillion (updated Feb 2025) ~$783,000/share

2023 - $1.035 trillion (updated May 2024) ~$720,125/ share

2022 - $923 billion

2021 - $889 billion

2020 - $791 billion

2019 - $760 billion

2018 - $791 billion

2017 - $611 billion

Christopher Bloomstran of Semper Augustus Investments, known for his detailed annual letters dissecting Berkshire Hathaway, currently pegs the company’s intrinsic value at roughly $780,000 per Class A share (as of year-end 2024). His valuation stems from a rigorous sum-of-the-parts analysis, combining the fair value of Berkshire’s massive investment portfolio with normalized earnings from its operating businesses—insurance, BNSF railroad, and Berkshire Hathaway Energy—using conservative, cycle-adjusted multiples. Bloomstran highlights Berkshire’s unmatched liquidity, diversified earnings base, and disciplined capital allocation as structural advantages that anchor intrinsic value growth around 10–12% annually. He argues that the company remains slightly undervalued versus intrinsic worth, with the “Buffett machine” continuing to compound capital at rates few large corporations can match.

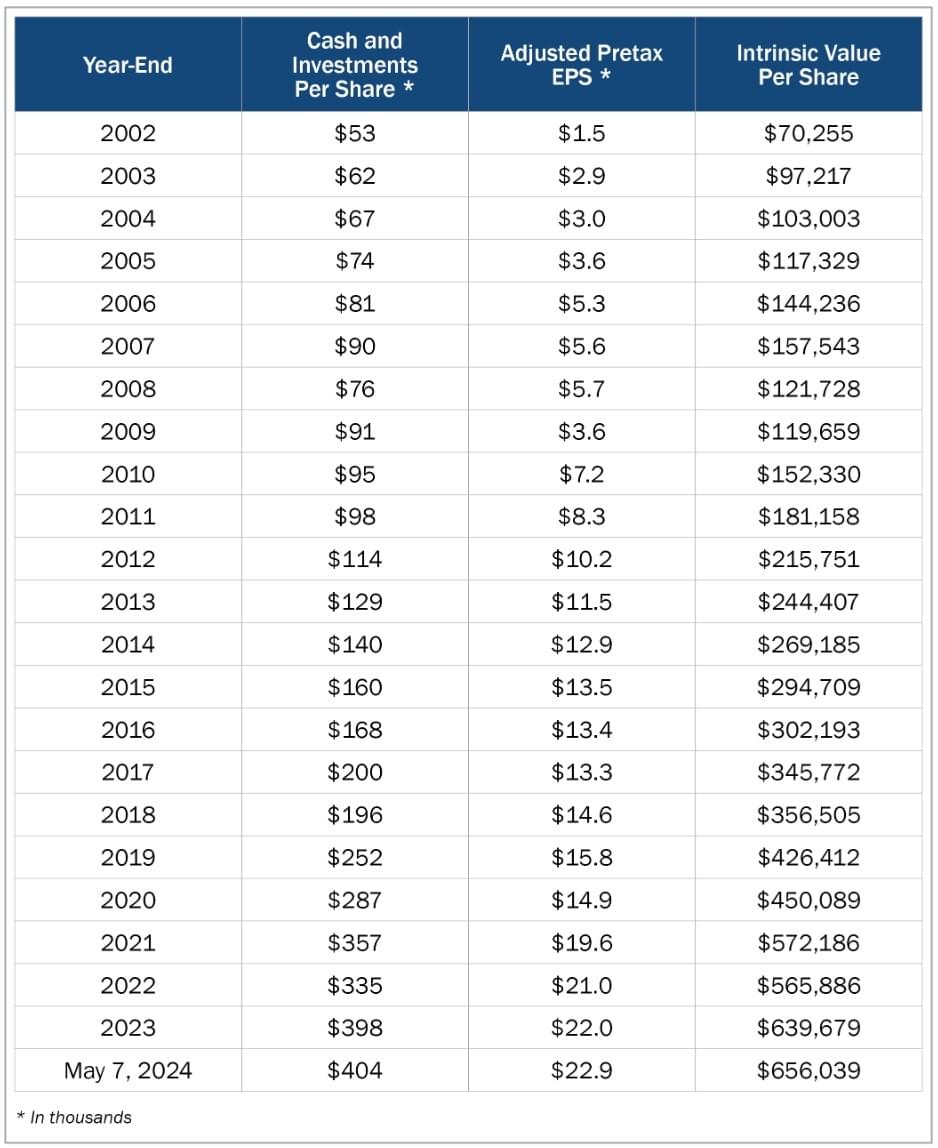

Whitney Tilson

Annual intrinsic value estimate by Whitney Tilson of Stansberry Research

May 2025 - $743,000

May2024 - $656,039

Feb2024 - $651,056

2023 - $639,679

2022 - $565,886

2021 - $572,186

2020 - $450,089

2019 - $426,412

2018 - $356,505

2017 - $345,772

Whitney Tilson values Berkshire Hathaway’s intrinsic worth at roughly $743,000–$749,000 per Class A share (about $495–$500 per Class B share). His approach—consistent with his long-running Berkshire model—adds the company’s vast cash and investment holdings to an earnings-based valuation of its operating businesses, applying a conservative multiple to normalized pre-tax profits. Tilson emphasizes Berkshire’s balance-sheet strength, durable earnings power from subsidiaries like BNSF and Berkshire Hathaway Energy, and a large portfolio of high-quality equities. He views the stock as modestly undervalued relative to this range, offering long-term investors a reasonable margin of safety.

AI Intrinsic Value of Berkshire

AI Intrinsic Value of Berkshire Hathaway:

Grok-4 - $1.2 trillion

ChatGPT - $1.1-1.2 trillion

See reports below with AI results written using Warren Buffet's tone and style.

$1.2 Trillion or $845,000 per BRK.A Share

To the Shareholders of Berkshire Hathaway Inc.:

Dear Fellow Owners,

It's that time again when I sit down to share my thoughts with you, the true owners of this remarkable enterprise we've built together over the decades. As many of you know, I've always believed that transparency is the bedrock of trust, especially in a business as sprawling and unconventional as ours. Today, I'd like to walk you through my own rough calculation of Berkshire's intrinsic value – that elusive but essential figure that represents the present value of all the cash we can expect to pull out of this company over its lifetime. Mind you, this isn't some precise mathematical formula etched in stone; it's an estimate, and estimates, by their nature, require judgment, assumptions, and a healthy dose of conservatism. My late partner Charlie Munger, who passed away in 2023, would nod approvingly at that caveat – he always reminded me that overprecision is the enemy of good thinking.

As I've written in these letters and our Owner's Manual for years, intrinsic value isn't about what the stock market says on any given day, nor is it simply our book value (though book value has served as a useful, if understated, proxy over time). No, it's the discounted stream of future cash flows, adjusted for the realities of our operations. But calculating that directly for a behemoth like Berkshire – with its insurance powerhouse generating float, its railroads chugging along, its utilities powering homes, its diverse manufacturing and retail businesses, and our hefty portfolio of marketable securities – would require a crystal ball I don't possess. Instead, as I've outlined in past reports and interviews, I break it down into two main buckets to make it manageable: (1) the value of our investments, including that mountain of cash on the balance sheet, and (2) the value of our operating businesses, capitalized at a reasonable multiple of their earnings power.

Let me emphasize: this approach avoids the pitfalls of GAAP accounting distortions and focuses on economic reality. We exclude volatile capital gains or losses from our thinking, as they don't reflect the underlying grind-it-out productivity of our businesses. And yes, we absolutely include our cash hoard – it's not just sitting there idle; it's ammunition for future opportunities, earning a decent return in Treasuries meantime, and it belongs in any honest valuation.

Now, let's roll up our sleeves and crunch the numbers using our 2024 year-end figures. All data comes straight from our annual report, and I'll use per-Class A share equivalents for simplicity (remember, Class B shares are 1/1,500th of an A share). Our total A-share equivalents outstanding at year-end were approximately 1,438,223.

Bucket 1: Our Investments and Cash (Valued at Market)

This is the straightforward part. Berkshire holds a vast portfolio of marketable equities, fixed-income securities, short-term investments (mostly U.S. Treasuries), and cash equivalents. We also have equity-method investments, which I include at their carrying value unless there's a compelling reason to adjust (and for this exercise, I'll stick to book for conservatism). I value the marketable stuff at year-end market prices – no discounts for taxes on unrealized gains, because we're not planning to sell en masse tomorrow; we're owners, not traders. If interest rates or market moods change, this number swings, but that's life.

Here's the tally (in millions):

- Cash and cash equivalents: $34,268

- Short-term investments (U.S. Treasury bills): $286,472

- Fixed-maturity securities: $15,364

- Equity securities: $271,588

- Equity-method investments (at carrying value): $31,134

Total: Approximately $638,826 million.

Per A-share equivalent: $638,826,000,000 ÷ 1,438,223 ≈ $444,200.

This cash and investment pile is largely courtesy of our insurance operations, which provide us with float – that wonderful liability where we hold policyholders' money interest-free (or better yet, at a profit when underwriting is sharp, as it was in 2024). The float stood at about $171 billion at year-end, up from $169 billion the prior year, and it's been a cost-free (often negative-cost) source of funds for decades. But note: I don't add extra value for the float here; its benefit shows up in our ability to invest it and in the operating earnings of our insurance group.

Bucket 2: Our Operating Businesses (Capitalized Earnings)

Now for the trickier bit: valuing the earnings engine of our controlled businesses, which include insurance underwriting, BNSF Railroad, Berkshire Hathaway Energy, manufacturing, service, and retailing operations. These are the workhorses that generate reliable cash without relying on our investment income.

As I've explained in prior letters (like back in 2010), I focus on normalized operating earnings, stripped of investment gains/losses and one-off items. In 2024, our after-tax operating earnings hit $47.4 billion – a solid 27% jump from 2023, thanks to standout performances across the board, especially in insurance where underwriting profits soared to $9.0 billion.

But for valuation, I prefer to think in pre-tax terms, as taxes can fluctuate and don't always reflect economic value. Based on our statements, pre-tax operating earnings (excluding investment gains) were roughly $57.6 billion in 2024 – a conservative normalization, smoothing out any unusual items. (If you back out the effective tax rate on these earnings, which hovered around 17-18% due to our mix of businesses, you land near our reported after-tax figure.)

To capitalize this, I apply a multiple to those pre-tax earnings. What multiple? As I've said in interviews and writings, for a collection of high-quality, durable businesses like ours – with strong moats, low capital needs in many cases, and proven management – something in the range of 10 times pre-tax earnings is reasonable and conservative. It's not the frothy 20+ times you might see in growth darlings; we're built for endurance, not hype. (If rates were higher, I'd shade it lower; at today's levels, 10x feels about right.) This multiple implicitly discounts future cash flows at a rate that accounts for reinvestment opportunities and risks.

So: $57.6 billion × 10 = $576 billion value for operating businesses.

Per A-share equivalent: $576,000,000,000 ÷ 1,438,223 ≈ $400,500.

A word of caution: This assumes our earnings power holds steady or grows modestly, which it has historically (operating earnings have compounded at over 20% annually in recent decades, but I never bake in heroic growth assumptions). If you think our businesses deserve a higher multiple – say, 12x for their resilience – you'd add another $115 billion or so to the total value. But I'm sticking with 10x to keep it grounded.

Putting It All Together: Estimated Intrinsic Value

Add the two buckets: Investments and cash ($444,200 per share) + Operating businesses ($400,500 per share) = Approximately $844,700 per A-share equivalent.

At year-end 2024, our Class A stock closed around $713,000, and as I write this in late 2025, it's trading nearer $720,000. So, by this reckoning, the market is pricing us a bit below my estimate – which could mean opportunity for patient owners, or perhaps a reminder that my assumptions are just that. Intrinsic value isn't static; it evolves with earnings growth, acquisition prospects, and economic winds. And remember, we don't subtract liabilities like deferred taxes or debt here beyond what's already embedded in the operating valuation – our structure keeps net debt minimal, and float acts as a positive leverage.

Why share this? Because you, our shareholders, are partners, not speculators. Use this framework to form your own view – tweak the multiple if you disagree, or discount for uncertainties like regulatory changes in utilities or cyclical dips in manufacturing. Charlie and I always aimed to buy businesses at a discount to intrinsic value, and we hope you see Berkshire the same way.

In closing, Berkshire's true worth lies not in spreadsheets but in the people running our operations and the culture of decentralization and integrity we've fostered. We'll keep allocating capital wisely, avoiding dumb deals, and letting compounding do its magic. Thanks for joining us on this journey.

Stay rational,

Warren E. Buffett

Chairman of the Board

Omaha, Nebraska

$1.1-1.2 Trillion or ~$800,000 per BRK.A Share

Estimating Berkshire’s Intrinsic Value – A Buffett-Style Appraisal

Investments per Share: Berkshire’s Stock and Bond Portfolio

One pillar of Berkshire Hathaway’s intrinsic value is the vast collection of marketable securities we own. These are the stocks, bonds, and equity stakes in other companies that show up on our balance sheet at market prices. At the end of 2024, those holdings were enormous – on the order of $300 billion in publicly traded stocks and bonds . (That sum excludes our sizable stakes in The Kraft Heinz Company and Occidental Petroleum, which together add roughly another few tens of billions.) In addition, we held $318 billion in cash and U.S. Treasury bills (net of pending transactions) as of year-end . Put another way, nearly one-third of Berkshire’s ~$1 trillion market value at that time was sitting in cash-equivalents – more than ten times the $30 billion minimum cash cushion Charlie and I insist on maintaining . We consider that extra liquidity part of our intrinsic value, since it’s available for opportunities or share repurchases.

On a per-share basis, the value of Berkshire’s investments is easy to calculate. Divide the total portfolio by the shares outstanding, and you get a hefty figure in the high hundreds of thousands of dollars per Class A share. (For perspective, one Class A share economically equals 1,500 Class B shares.) By late 2024, the investments – stocks, bonds, and cash – came to roughly $440,000 per Class A share . That number alone exceeds Berkshire’s book value, underscoring why Charlie and I emphasize intrinsic value instead. Book value reflects historical costs, whereas the marketable investments are carried at current prices (with stocks even marked up for unrealized gains under GAAP). More importantly, book value ignores a **“major component of Berkshire’s intrinsic value” – our insurance float – which doesn’t belong to us but which we get to invest for our benefit . Thanks to float, we’ve been able to hold a much larger investment portfolio than our own equity would otherwise permit. (At mid-2024 our float stood around $169 billion , provided cost-free by our insurance operations.) All this is to say: the raw value of our investments per share gives a solid, if incomplete, foundation for gauging Berkshire’s intrinsic worth.

Earnings Power of the Operating Businesses

The second pillar of intrinsic value is the earning power of Berkshire’s diverse wholly-owned businesses – the railroads, utilities, manufacturers, retailers, and insurers that we control outright. Unlike the stock portfolio (whose value we know to the penny each day), these operating subsidiaries do not have quoted market prices. We must estimate their value, and the method we favor is to look at normalized earnings and capitalize those earnings at a reasonable rate. In plainer terms, we ask: “How much would a rational buyer pay for these businesses if they could receive Berkshire’s share of the earnings every year going forward?” Warren Buffett (the narrator of this memo) might quip that stocks are worth the cash they can produce for owners over time – and our subsidiaries produce plenty of cash.

Last year, Berkshire’s operating businesses delivered record results. All told, we recorded about $47.4 billion in operating earnings in 2024 (after taxes and excluding any capital gains or losses on our investments). This figure – which we highlight “endlessly” in our reports – reflects the true earnings power of our businesses, stripped of the volatile swings in investment values . It includes profits from insurance underwriting, railroading, energy generation, manufacturing, services, and retailing, but excludes the flood of investment income and accounting gains that can obscure our real economic performance . In 2024, for example, GEICO had a stunning turnaround, contributing significantly to that earnings surge . We consider such results sustainable on average, though any given year will have its surprises – insurance profits can swing with the winds (or hurricanes), and economic cycles will buffet some of our businesses. So when we say “normalized” earnings, we mean a level that smooths out the highs and lows. Given our broad mix of enterprises, the $47 billion achieved last year is a fair representation of current earning power. It certainly didn’t come from squeezing the last drop out of the businesses; we continue to reinvest in growth and uphold strong balance sheets across our subsidiaries.

To value these earnings, we apply a conservative capitalization rate. Put yourself in the shoes of a private buyer of an entire business: you might demand an 8% annual return on your purchase, which equates to paying about 12 to 13 times after-tax earnings. (If prevailing interest rates were lower, buyers might pay more; if higher, they’d pay less. We think our assumption is reasonable in today’s environment.) Using roughly a 12× multiple, Berkshire’s $47 billion in look-through operating earnings would be valued around $570 billion (give or take a few dozen billion) as a whole. On a per-share basis, that adds roughly $395,000 of value per Class A share attributable to our wholly-owned operating businesses. If you prefer a slightly higher multiple to reflect Berkshire’s quality and durability – say 13× earnings (a ~7.5% earnings yield) – you’d get an even larger figure, on the order of $615 billion for the businesses. But Charlie and I are content to be conservative; we’ll use the lower figure and keep our margin of safety. Either way, the earnings engine of our companies contributes a very large chunk of intrinsic value – several hundred thousands of dollars per Berkshire share.

It’s worth noting that this approach mirrors the “two-column” valuation method we’ve shared in past shareholder letters . One column tallies the per-share value of our investments; the other column tallies the per-share earnings of everything else. In decades past, when Berkshire was smaller, we even published a table of those two columns so that readers could make their own intrinsic value estimates. The idea remains the same: add the value of the investments to the value of the operating earnings. We’ve just crunched the numbers for today’s Berkshire.

Excess Cash and Deployment Discipline

The third element of our intrinsic value calculation is excess cash – that mountain of liquidity I mentioned earlier. Berkshire’s cash (including T-bills) isn’t earning much sitting on the sidelines, but it’s an asset that adds to our intrinsic value because it’s available for productive uses. However, we must distinguish required cash from excess cash. We will always keep at least $30 billion on hand to ensure we can meet insurance claims at the worst of times . That’s a bedrock principle around here; financial strength and redundant liquidity will always be paramount . But beyond that safety stash, every extra dollar in the till is a dollar that can be put to work – buying businesses, buying stocks, or buying back Berkshire shares when available at the right price.

At the end of 2024, Berkshire’s cash and equivalents (net of short-term liabilities for security purchases) totaled about $318 billion . Subtract our $30 billion rainy-day reserve, and you have roughly $288 billion in truly excess cashavailable. That sum is already counted in the “investments per share” pillar above, but it’s worth highlighting because it’s essentially dry powder. In our intrinsic value equation, excess cash is like a gift card in the hands of a skilled shopper – you know it’s going to be spent on something valuable sooner or later. Indeed, Charlie and I view Berkshire’s hoard of cash as an advantage for our shareholders: it enables us to move quickly on large opportunities or simply wait patiently while earning interest (which, at over $300 billion, even a modest yield produces substantial income). We won’t treat cash as a hot potato burning a hole in our pocket; we’ll deploy it only when it increases per-share value over the long run. Until then, it’s comforting to have this war chest. It’s also part and parcel of Berkshire’s value. Any sum that large – on the order of $200,000 per Class A share in excess cash – can’t be ignored in valuation. We simply add it (dollar for dollar) on top of the values computed for our investments and operating businesses. As Ben Franklin might say, cash earns its keep.

There is also an intangible but crucial factor related to cash: the discipline and ability to deploy it wisely, which brings us to what I’ve often called the “third pillar” of intrinsic value . Unlike the first two pillars (which we can measure with reasonable precision), this one is subjective. It asks: How effectively will Berkshire reinvest its earnings and cash in the future? A strong balance sheet and ample cash mean little if managed by a CEO prone to value-destroying deals. Conversely, a talented capital allocator can create additional value by investing retained earnings at high rates of return . Charlie and I don’t explicitly quantify this factor in our intrinsic value math – that would require a crystal ball – but we certainly hope that Berkshire’s record and culture suggest a positive contribution here. We have more than $0.3 trillion in purchasing power; deployed intelligently, those funds can generate more earnings (and thus more intrinsic value) down the road. In effect, Berkshire shareholders have entrusted us with a large pile of chips, and our job is to bet them wisely. If we succeed, the third pillar will add a bit to intrinsic value beyond the simple sum of current investments and current earnings. If we falter, shame on us – and intrinsic value will be less than it could have been. We’ll do our best to make sure it’s the former.

Putting the Pieces Together (Per-Share and Total)

Let’s aggregate those components. First, Berkshire’s investments (stocks, bonds, and equity stakes) contribute roughly $440,000 for each Class A share . Second, our operating businesses’ earnings, capitalized conservatively, contribute on the order of $395,000 per A share. Third, our excess cash (above requirements) accounts for about $200,000 per A share. Now, if you add those up, you’ll arrive at an intrinsic value in the vicinity of $1.1 to $1.2 trillion for Berkshire Hathaway as a whole. In per-share terms, that’s roughly $800,000 per Class A share. For our many Class B shareholders, divide that by 1,500 – you get about $533 per Class B share. To be clear, this is an estimate, not a pinpoint calculation. It’s what the business is worth to a long-term owner, today. Charlie and I would be surprised if any two analysts (or both of us, for that matter) arrived at exactly the same figure for intrinsic value . But we’d also be surprised if careful minds thought we were off by a mile. As the saying goes, we prefer to be approximately correct rather than precisely wrong. And an estimate of ~$800,000 per share – give or take a few percent – feels approximately right given Berkshire’s assets and earning power.

It’s worth noting how this compares to Berkshire’s market price. Mr. Market, with his daily mood swings, puts a price on our shares that can deviate from intrinsic value in the short run. In fact, at times our stock has overperformed or underperformed the business significantly . But in the long run, the two inevitably converge. As I wrote back in 1996, over time “the aggregate gains made by Berkshire shareholders must of necessity match the business gains of the company” . When the stock price runs too far ahead of intrinsic value, eventually either the price stagnates or the intrinsic value catches up – and vice versa. In early 2025, Berkshire’s market capitalization has been hovering around the trillion-dollar mark. That’s in the same ballpark as our intrinsic value estimate (perhaps a bit lower, based on the calculation above). We don’t obsess over that difference. After all, we never aim to “maximize the price” in the short term by any flashy actions. Instead, our goal is to steadily increase Berkshire’s intrinsic value per share over the years, and let the market recognize that progress in due course. If the market offers us a bargain (trading below intrinsic value), we’ll be happy to buy back some stock, as we did opportunistically in the past . If the market overvalues us, we’ll use our stock sparingly (for example, as currency in an acquisition) or simply enjoy the high quote. But mostly, we focus on widening the gap between what our businesses are worth and the price you paid for your shares.

Caveats and a Long-Term View

Estimating intrinsic value is inherently an art as well as a science. We’ve made several assumptions that could change: the earnings of our businesses will not grow uniformly (some years will be better, some worse), interest rates will influence what valuation multiples are “reasonable,” and our own capital allocation decisions will affect future per-share results. We’ve also assumed our insurance float remains cost-free and stable (or growing) – a fair assumption given a 12-year streak of underwriting profits through 2024, but not a guarantee . If our insurance operations were to suffer large underwriting losses for years on end, part of that $169 billion float could effectively become a liability rather than an asset. I don’t lose sleep over that scenario, but nothing is assured in this world. Economic moats can be breached, consumer preferences shift, and even the best businesses face competitive assaults. So when valuing Berkshire (or any enterprise), one must introduce a healthy dose of caution. In our case, we’ve baked in caution by using moderate valuation multiples and by not assigning any speculative premium for future “home run” investments. Intrinsic value is not a precise figure – it’s a range that becomes clearer only in retrospect.

One important caveat: no two analysts will ever agree exactly on intrinsic value, and neither will Charlie and I . Ask us independently, and you’ll get two answers (hopefully not too far apart!). Precision simply isn’t possible. We know we’ve been roughly right in building value – Berkshire’s book value has compounded at nearly 20% for over half a century, and our true intrinsic value has grown even faster – but we can’t put it on a scale and weigh it. That’s why we provide shareholders the tools and transparency to make their own estimate. We break out operating earnings, detail our investments, and discuss our philosophy, so that you can refine the calculation as you see fit. Think of it like estimating the weight of a mature oak tree: you can measure the trunk’s diameter and height (our earnings and assets), but the deep roots and future growth are harder to gauge. Two arborists will give you two different weight estimates, but both will agree it’s one solid tree.

Finally, I encourage all our owners to maintain a long-term perspective. If you plan to hold Berkshire stock for many years (as most of our shareholders do – we’re blessed with a stable, like-minded owner base ), the day-to-day gyrations in market price fade into irrelevance. What counts is that Berkshire’s intrinsic value per share keeps increasing over time. Charlie and I have essentially all of our net worth riding on that outcome. We measure our success by the growth in your per-share intrinsic value, not by the stock price on any given day. We’ve always operated as if each shareholder is a long-term partner entrusting us with their savings. That mindset won’t change. If we do our job, Berkshire will continue to compound its intrinsic value over the years ahead, and patient shareholders will benefit accordingly. As Ben Graham taught, in the short run the market is a voting machine, but in the long run it’s a weighing machine. Eventually, the weight of Berkshire’s performance will show through in the market price. In the meantime, we’ll just keep adding weight to the scale – ton by ton, year after year.

Intrinsic Value Bottom Line: By our estimate, Berkshire Hathaway’s total intrinsic value is on the order of $1.1–$1.2 trillion, roughly $800,000 per Class A share (about $533 per Class B). We arrive at this figure by adding up three components: the per-share value of our investments (stocks, bonds, etc.), the capitalized value of our companies’ earnings, and our excess cash holdings. We’ve used conservative assumptions, and we’ve included the same caution we always do – intrinsic value is an estimate, not a guarantee. But we believe this approach, grounded in the principles we’ve discussed in shareholder letters for decades, gives a sound approximation of Berkshire’s true worth in early 2025.

© 2026