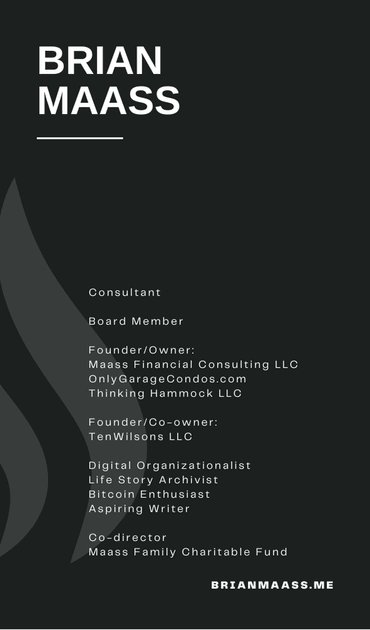

brian maass

my work resume

25+ year Banking / Finance Executive

I’ve always been fascinated by the power of compounding—whether it’s financial, intellectual, or reputational. That curiosity about money and systems began early, growing up in the suburbs of Chicago, where one of my first jobs was as a bank teller in high school. I earned a degree in accounting, became a CPA, and launched my career in public accounting—working in the banking group at Crowe, where I learned the foundational mechanics of how banks operate.

Driven by a desire to build things and challenge myself, I pursued an MBA in Finance while deliberately transitioning from accounting into corporate finance, then treasury, and ultimately capital markets. I’ve spent my entire career in banking—but always gravitating toward roles that required strategic thinking, transformation, and calm leadership in the face of complexity.

For over a decade, I led Global Funding and Liquidity at one of the largest banks in the U.S. guiding the institution through the 2008-2009 financial crisis and managing billions in global issuance and funding strategy across currencies and regulatory regimes.

From there, I became Treasurer and Chief Investment Officer of a regional bank, then advanced to Chief Financial Officer for a publicly traded bank where I led multiple transformative mergers, increasing the bank’s size from $18 billion to $48 billion and helping position it to compete in a changing industry.

Today, I serve as a Board Director at Horizon Bank, where I chair the ALCO Committee and sit on the Audit Committee. I also

operate independently through Maass Financial Consulting LLC, where I advise executive teams, boards, and banks on strategy, capital, liquidity, M&A, and navigating disruption.

While I’ve spent decades in traditional finance, I’ve also spent the last several years researching and understanding the evolving world of digital assets (bitcoin and stablecoins) and how they will intersect with tradfi, capital markets, and regulatory frameworks. I understand the emerging threats and opportunities better than most traditional banking executives, and I bring a level of operational and risk-seasoned insight that most fintech founders and investors simply haven’t lived through. I bring a rare combination of practical experience, strategic clarity, and future-focused thinking to every conversation.

my thoughts on the banking industry today

“It’s an industry still in consolidation.”

When I started my career, the U.S. had over 10,000 banks. Today, that number is under 4,500—and dropping. I’ve spent the last 25+ years directly in the middle of that transformation.

Banking is one of the oldest industries in the world—arguably going back thousands of years. And yet, in the U.S., we’ve long had more banks than most developed economies. The last few decades have been defined by mergers, acquisitions, and consolidation—a trend that is far from over.

I’ve been fortunate to participate in this shift firsthand. Over the course of my career, I’ve worked on dozens of bank acquisitions, nearly all from the acquirer’s side. These were growth-driven organizations, many compounding at 15%+ annually, expanding their footprint and capabilities through strategic mergers.

But the next wave of transformation won’t be driven by M&A alone.

The industry now faces rising pressure from Big Tech, FinTech, Credit Unions, non-bank lenders, CBDCs, and yes—even Bitcoin. These forces are reshaping customer expectations, product delivery, infrastructure, and trust. Banks that survive and thrive will need to do more than just scale—they’ll need to specialize, digitize, and adapt.

I believe the future of banking is one of convergence and complexity. Traditional institutions must evolve not only through consolidation, but by rethinking how they deliver value in a world of faster, cheaper, decentralized alternatives.

This is the moment for leadership that understands both the legacy systems and the disruptive innovations. That’s where I focus my work.

© 2025